1/5

Como instalar

1

Faz download e abre o ficheiro de instalação2

Unblock AptoideAptoide is a safe app! Just tap on More details and then on Install anyway.3

DetalhesAvaliaçõesVersõesInfo

1/5

Descrição de Branch - Digital Bank & Loans

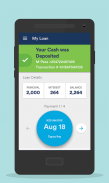

Os empréstimos pessoais variam de Ksh 500 a Ksh 300.000

: 62 dias a 1 ano. As taxas de juros variam de 2% a 18%, dependendo do perfil de risco do cliente.

: empréstimo de Ksh 10.000 com APR de 196% (ao ano) com prazo de 62 dias

Juros = Ksh. 10000* 196%/ 365 *62 = Ksh. 3260

O valor total desembolsado será de Ksh 10000

O valor total a pagar será de Ksh 13260 (Ksh 10000 + Ksh 3260)

Dois pagamentos mensais de Ksh 6630

Alguns clientes podem ser cobrados uma taxa de atraso.

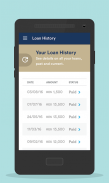

A Branch agora é mais do que apenas um aplicativo de empréstimo móvel. Agora você pode economizar dinheiro, fazer transferências da carteira da Branch, pagar suas contas e obter empréstimos móveis instantâneos no aplicativo Branch.

Branch - Digital Bank & Loans - Versão 4.84.2

(22-04-2024)NovidadesBetter than your bank - we've totally redesigned our app to help you manage your finances on the go. Update now to see our sleek new design and get access to new products and features.If you like the new update, share the love by leaving a 5-star review and inviting your friends. Have feedback? Let us know by messaging Customer Care in the app.

Boa aplicação garantidaEsta aplicação passou no teste de segurança contra vírus, malware e outros ataques maliciosos e não contém nenhuma ameaça.

Branch - Digital Bank & Loans - Informação APK

Versão APK: 4.84.2Pacote: com.branch_international.branch.branch_demo_androidNome: Branch - Digital Bank & LoansTamanho: 48 MBTransferências: 15KVersão : 4.84.2Data de lançamento: 2024-04-22 11:50:39Ecrã mínimo: SMALLCPU Suportado:

ID do Pacote: com.branch_international.branch.branch_demo_androidAssinatura SHA1: BD:C0:47:55:06:4D:97:E0:3F:12:E1:88:79:10:07:79:AA:E6:7D:CFProgramador (CN): Random BaresOrganização (O): Branch IntlLocalização (L): San FranciscoPaís (C): USEstado/Cidade (ST): CA